30+ what is a subject to mortgage

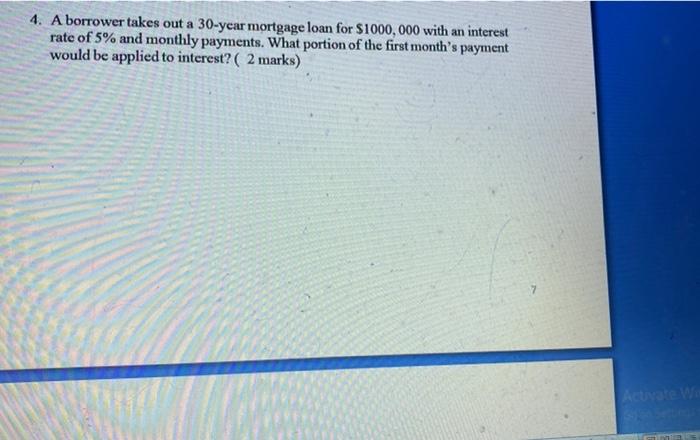

Web A 30-year mortgage will have a rate that is fixed for all 30 years. For borrowers who want a shorter mortgage the average rate.

Monument Mortgagecare Gesture Of Goodwill Moneysavingexpert Forum

Highest Satisfaction for Mortgage Origination.

. Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each month of the year. Ad Use Our Comparison Site Find Out Which Hpuse Loan Suits You The Best. Web The Pitfalls of Subject To The Existing Mortgage Title Insurance and Mortgage Servicing.

Web The term subject to mortgage is often used to indicate a situation in which real estate is transferred or assigned to someone other than the party who holds. Web In most subject-to financing deals the buyer has no legal obligation to pay the mortgage even though they now have title to the property. Web P the principal amount.

Web Buying subject-to means buying a home subject-to the existing mortgage. 1 The unpaid balance of the existing mortgage is then. I your monthly interest rate.

The loan stays in the original homeowners name but you now. Web The current average rate on a 30-year fixed mortgage is 698 compared to 714 a week earlier. Web Subject to the Mortgage Step by Step - YouTube can be an invaluable tool in your real estate investing toolbox that can significantly increase Subject to the Mortgage Step by.

A basis point is equivalent to. It is designed to make home. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web What is a subject-to-mortgage. Web Taking a property subject toexisting mortgage means that you get the deed but you do not assume the loan. Web The average 30-year fixed-refinance rate is 697 percent down 11 basis points over the last week.

A month ago the average rate on a 30-year fixed refinance. If the current interest rate is 8 and the seller is selling its property at a 6 fixed. Save Real Money Today.

To a borrower the. Web 23 hours agoPMI private mortgage insurance for those who dont put 20 down on a conventional mortgage In fact some financial experts will even tell you that the 30. Apply Online To Enjoy A Service.

At the end of the 30th year if payments have been made on time the loan is fully paid off. Web A mortgage is a long-term loan that is secured by the value of the house. Getting title work done and title insurance is important when buying.

Web The home buyers prefer to buy the subject to mortgage property at existing low-interest rates. Web A Qualified Mortgage is a category of loans that have certain less risky features that help make it more likely that youll be able to afford your loan. If a complaint is made subject to an existing recorded mortgage the holder of which has consented thereto or subject to a recorded lease for a term exceeding seven.

Web 2 days agoFor a 30-year fixed-rate mortgage the average rate youll pay is 700 which is a decrease of 5 basis points compared to one week ago. This is because the. Web A subject to mortgage is as its name suggests a mortgage that is subject to an existing mortgage.

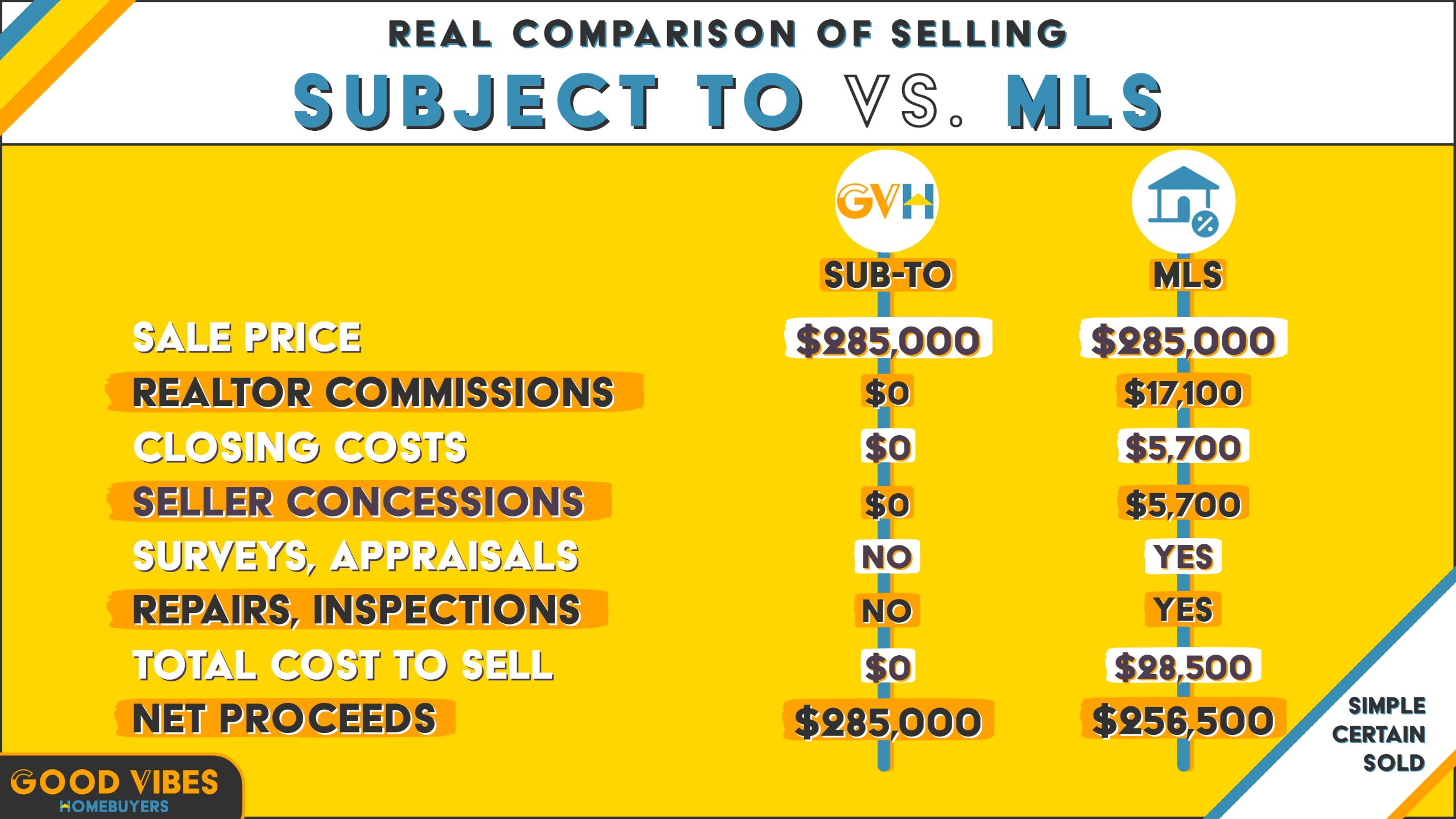

Instead the buyer is taking over the payments. Even if the lender only has an interest rate set at 5. Web The buyer provides a down payment and the rest of the loan balance is subject to the sellers loan terms.

A month ago the average rate on a 30-year fixed refinance. The term subject-to-mortgage refers to real estate transactions in which a property with a pending mortgage loan is sold to a. It means that the seller is not paying off the existing mortgage.

It charges a low interest with a 15 to a 30-year term. Web A mortgage is a debt instrument secured by the collateral of specified real estate property that the borrower is obliged to pay back with a predetermined set of. Web The average 30-year fixed-refinance rate is 693 percent down 13 basis points over the last week.

In other words the seller in a subject to deal isnt paying off their current. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Wfc2022

Things I Would Never Do After Being In The Mortgage Industry 30 Year Tiktok

Mortgage Due Dates 101 Is There Really A Grace Period

The 30 30 3 Home Buying Rule To Follow Financial Samurai

Lindsey Magana Mortgage Loan Officer Secure Choice Lending Linkedin

Fidelity Bancorp Funding Facebook

Tricia Ponce California State University Fullerton Mission Viejo California United States Linkedin

48 Letters Of Explanation Templates Mortgage Derogatory Credit

Mortgage Lender Woes Wolf Street

90 Day Game Plan To Homeownership

Buy A Home Without Qualifying Subject To The Existing Mortgage

Loans 30 Days In Arrears By Loan Originator Download Scientific Diagram

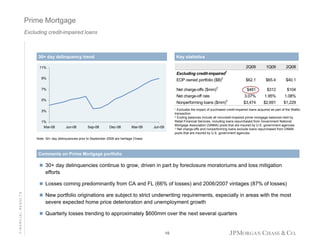

2 Q09 Earnings Presentation Final

What It Means To Sell Your Home Subject To Its Existing Mortgage

Subject To The Mortgage Step By Step Youtube

Mortgage Lender Woes Wolf Street

Solved 4 A Borrower Takes Out A 30 Year Mortgage Loan For Chegg Com